If you make the 5 down payment one year later youll have 15 equity. For example lets say youre in a local market where property values are increasing by 10 per year.

10 Factors You Need When Using A Down Payment Florida 2018

It depends mostly on your financial.

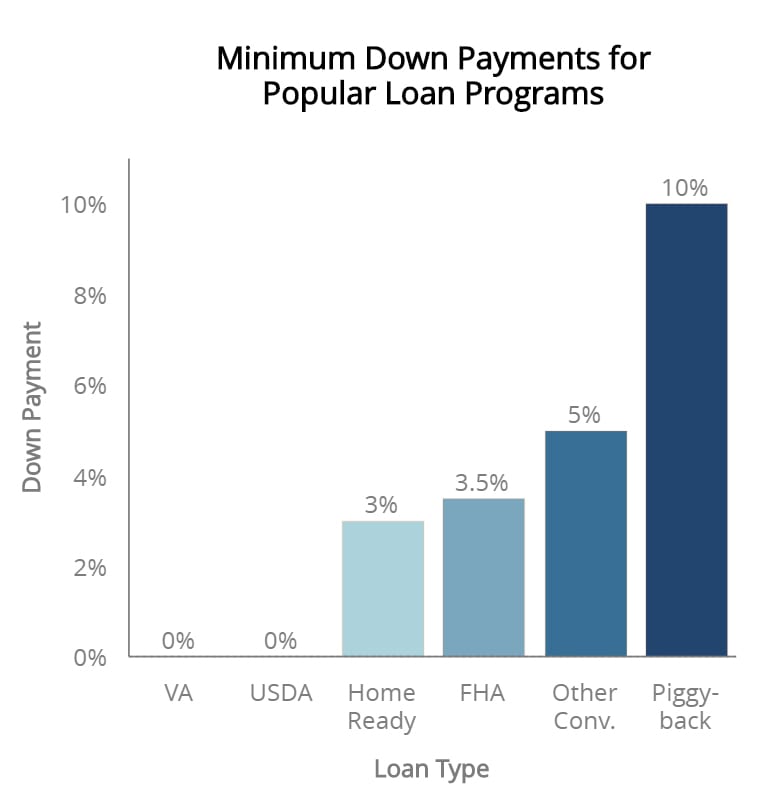

Putting 10 down on a house. Putting 10 down on a house - thoughts. You often have to make at least a 20 down payment because there are added lender risks with a home thats being built to your specifications. 10 Iowa-based entrepreneur Richard Dedor and his husband put down between.

Another risk you face with a big down payment is a drop in your homes value. This will give you some financial cushion to deal with unexpected expenses and whatever else life throws at you as you become a homeowner. There are specific length-of-service.

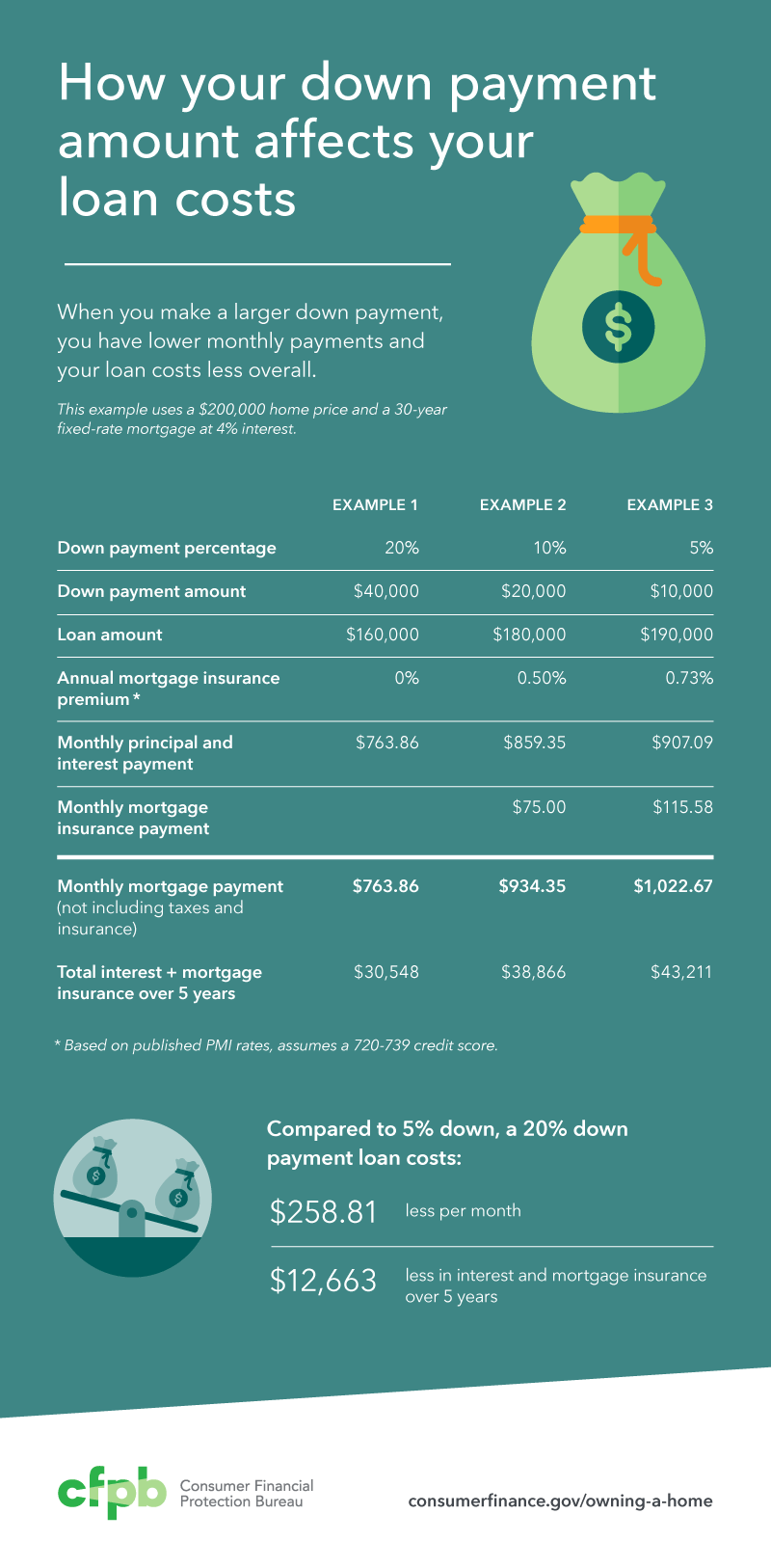

Buying this house with a 400 interest rate will cost you 44 more each month and 1577439 more in interest paid over the 30-year life of your mortgage as compared to. You dont need a down payment to qualify for a VA loan. Doubling a down payment on a 500000 loan from 10 percent to 20 percent means paying an extra 50000 up front.

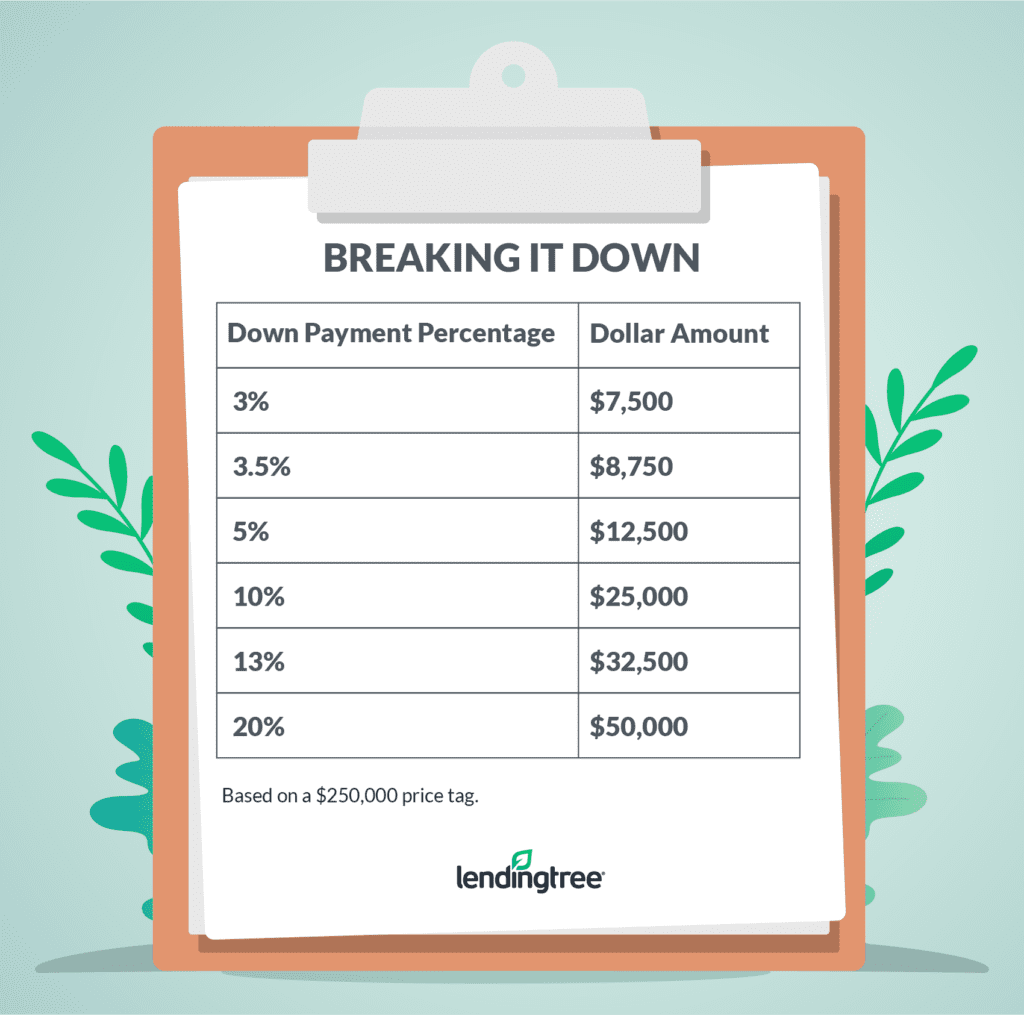

First-time buyers should put down between 5 and 10 says Joelle Spear a financial advisor with Canby. A 10 down payment would be 25000 of the purchase price. Some mortgage programs dont require a down payment however in the majority of cases youll be required to have a stake in the investment.

Two years later youll be up to 25 equity. Putting 10 down on a house - thoughts. Somedouche its not impossible to put two to three percent down on a house though the average is slightly higher than thatthe National Association of Realtors said it was 11 percent in 2016 as I reported yesterday while Attom Data Solutions put it at six percent.

On a 5 percent 30-year mortgage that higher down payment means paying 9662789 less over the life of the loan -- 50000 in less principal repayment plus a total of 4662789 less interest. New construction is different. Theres no right amount to put down on a home but there are some guidelines to consider.

If you put down 40000 a 10 down payment then your loan amount would be 360000. One way to plan is to put 10 percent down on your home and remain liquid through things like cash savings. If you put down 20000 5 down payment then your mortgage loan amount would be 380000.

The minimum credit score required by Rocket Mortgage is 580. Posted by udeleted 1 year ago. How Much Should You Put Down on the House.

A 5 down payment gives you only 16 equity in your home because the rest of the cash goes to mortgage default insurance. The need for a large down payment is less important in that kind of market. The cost of buying and then selling a home runs about 8 to 10 of the purchase price depending on where you live said Casey Fleming mortgage advisor and author of The Loan Guide Buying with a low down payment only makes sense if you plan on being in the home long enough to make back at least your acquisition and sale costs.

In fact 20 percent down would be more unusual than three to five percent these days. Our mortgage lender. As you can see the more money that borrowers put down the smaller the amount of the original mortgage loan.

Save more than 96000 long-term. If there is more equity in the property the lender is more likely able to recover its loss in the event of foreclosure. If a buyer put 10-20 down they may be more committed to the home and less likely to default.

Down payments are often but not always part of the normal homebuying process. A 10 down payment is enough to lower your monthly mortgage payment reduce your mortgage default insurance and secure enough equity in your home to whether small dips in the real estate market. To be able to put down the minimum 35 FHA down payment youll need a credit score of 580 or higher.

A small down payment could be in your best interest If you put down 10 20000 on the average home or 5 10000 on the average home then you will be able to become a homeowner faster since. How much you should pay on a down payment is a personal choice. If your credit score is between 500 and 579 youll be required to put down at least 10.

Having money left over after your purchase is importantif that means putting a little less down so be it Down payment.

How To Decide How Much To Spend On Your Down Payment Consumer Financial Protection Bureau

How To Decide How Much To Spend On Your Down Payment Consumer Financial Protection Bureau

How To Decide Between A 5 10 And 20 Down Payment

How To Decide Between A 5 10 And 20 Down Payment

When Does It Make Sense To Put Less Than 20 Down On A House Money Under 30

When Does It Make Sense To Put Less Than 20 Down On A House Money Under 30

How Much Should You Put Down On A House Not 20

How Much Should You Put Down On A House Not 20

You Only Need To Put 10 Down On A House

You Only Need To Put 10 Down On A House

How Much Is A Down Payment On A House Do You Need 20 Percent Thestreet

How Much Is A Down Payment On A House Do You Need 20 Percent Thestreet

How To Buy A House With 0 Down In 2021 First Time Buyer

How To Buy A House With 0 Down In 2021 First Time Buyer

Why We Put 10 Down On Our House The Freedom Adventure

Why We Put 10 Down On Our House The Freedom Adventure

How Much Should You Put Down On A House Lendingtree

How Much Should You Put Down On A House Lendingtree

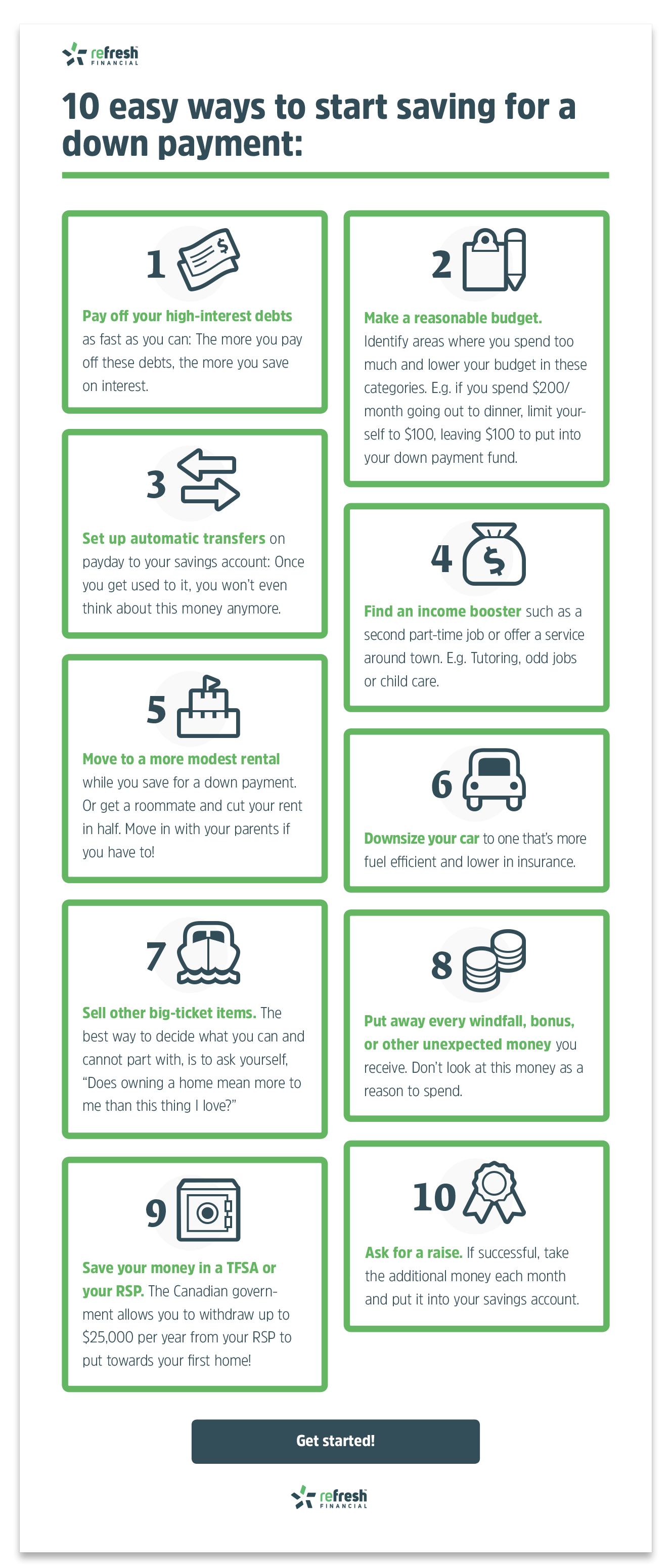

10 Tips For Saving A Down Payment For A House Refresh Financial

10 Tips For Saving A Down Payment For A House Refresh Financial

How Much Should You Put Down On A House Not 20

How Much Should You Put Down On A House Not 20

How Much Percent Do You Need To Put Down On A House Online

How Much Percent Do You Need To Put Down On A House Online

How Much Do I Have To Put Down For A House Clearance Sale Find The Best Prices And Places To Buy

How Much Do I Have To Put Down For A House Clearance Sale Find The Best Prices And Places To Buy

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.