If were basing eligibility on age alone a 36-year-old and a 66-year old have the same chances of qualifying for a mortgage loan. Mortgage lenders are not allowed to use age as a reason to deny your request for a mortgage loan whether you are 60 70 80 or 90.

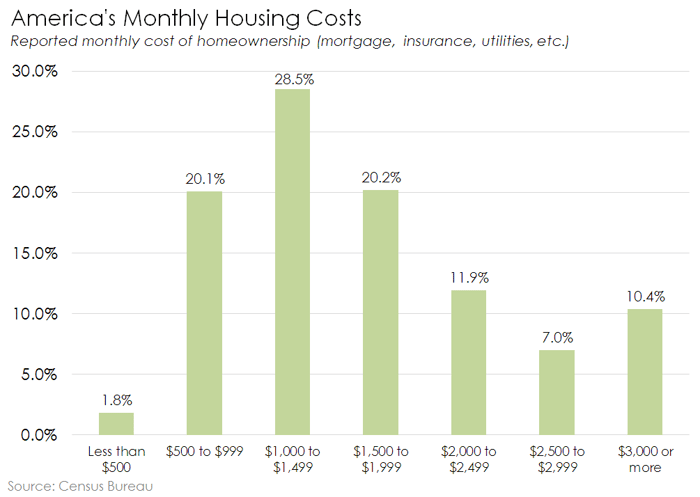

What Is The Average American S Mortgage Payment Millionacres

What Is The Average American S Mortgage Payment Millionacres

However your age will play a part in how the mortgage is calculated.

Age to get a mortgage. Its never about age. This doesnt mean though that lenders have to. In fact mortgage discrimination because of age is illegal under the Equal Credit Opportunity Act.

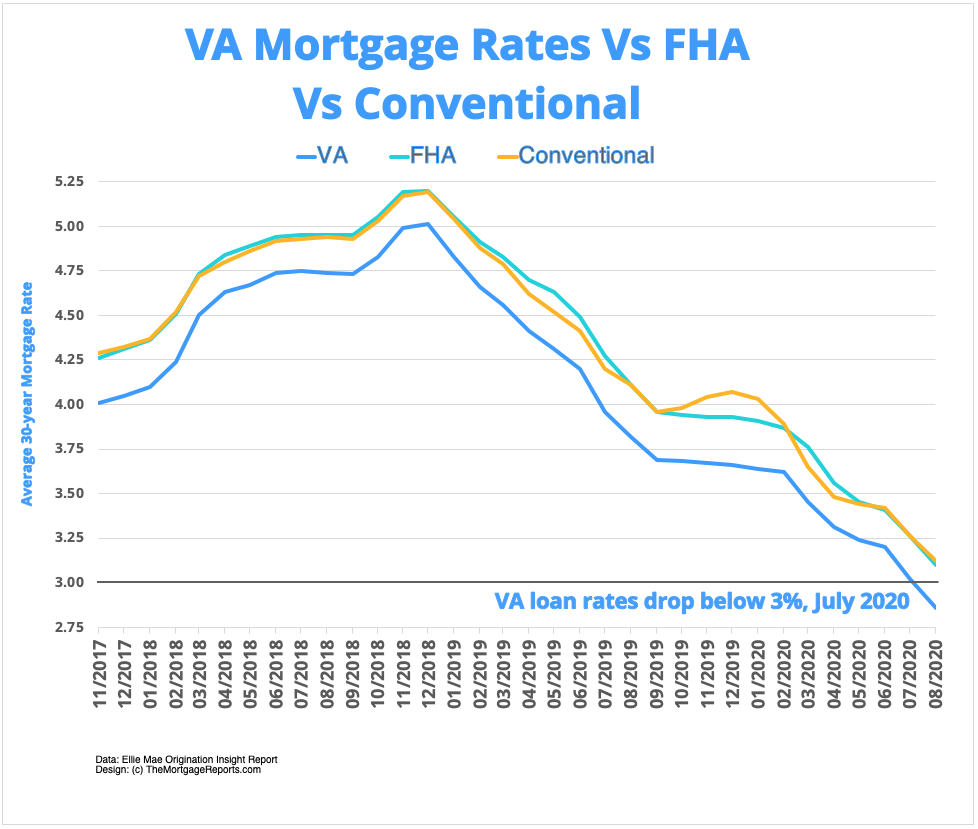

But this isnt to say that mortgage lenders. Borrowers in their 20s may find it easier to get a mortgage through the Federal Housing Administration FHA or Veterans Affairs VA. The Home Purchase Process for Seniors To lenders age isnt a factor a 67-year-old has as much chance of buying a home as a 37-year-old.

You typically must be at least 18 years of age to get a mortgage but theres no maximum age limit. Since some mortgage providers wont lend to anyone over a certain age being in your retirement years could limit your options when it comes to term lengths. You must meet your states age of majority or the legal contract age to get a mortgage.

Usually a maximum age of 65 to 80 When the mortgage term ends. If youre 65 youre not too old to buy a house provided that you have the finances to make a downpayment cover your monthly mortgage payments and keep up with expenses like maintenance and property taxes. So long as your mortgage payments are no more than 45 percent of your gross income you should be able to get the mortgage.

Typical age limits can be. Still young aspiring homebuyers tend to face several challenges when applying for a mortgage even after turning 18. In fact the Equal Credit Opportunity Act prohibits.

Generally jumbo programs also use a 62-year-old minimum age but there are also several programs now available for borrowers down to 60 years of age. When you take out the mortgage. Usually a maximum age of 70 to 85.

Some lenders have an age limit so if for example the provider has an age limit of 75 on a standard residential mortgage and youre 60 you might be limited to a restricted term. Your age when you take out a new mortgage with the limit ranging from around 70 to 85 your age when the mortgage term ends with the limit ranging from about 75 to 95. Granted you still need to go through the application process and financially qualify for the loan but age alone will not automatically keep you from qualifying for a new home loan refinance loan or home renovation loan.

Will you have enough cash. The reason youre never too old to get a mortgage is that its illegal for lenders to discriminate. In fact as long as youre a legal adult over the age of 18 its illegal for a mortgage lender to decline you based on your ageregardless of being 21 60 or 99-years-old you cant be denied a mortgage because of your age.

Each lender sets its own age limit for mortgage applicants. Typically this is either. Whether youre 20 or 90 lenders are supposed to qualify you based on your ability to pay not your age.

In most states 18 is the minimum age required to buy a home Leyrer said. What is the minimum age for a Jumbo Reverse Mortgage. If you are looking to buy a home but are over 40 years old you may be wondering if lenders will be less likely to approve your mortgage application.

Considerations when deciding whether to get a 30-year mortgage. HUD has established the minimum age for a reverse mortgage borrower to be 62 years of age by the time the loan closes. A standard rule of thumb applies regardless of age.

As long as you are 18 or older your age wont lower your chances of qualifying for a mortgage loan. When Are You Too Old for a 30-Year Mortgage. If you are over 18 or under 150 years old you can apply for a loan without any prejudices regarding your age.

For homebuyers who are a little older its important to know that a lender cannot deny you a mortgage based on your age.