Climate Change Trumps America First energy plan started with an announcement in June 2017 that the US. Along with tax reform these areas represent the four main points of the Trump policy compass.

Your Guide To Trump S Economic Address Marketplace

Your Guide To Trump S Economic Address Marketplace

Well be paying the price for decades.

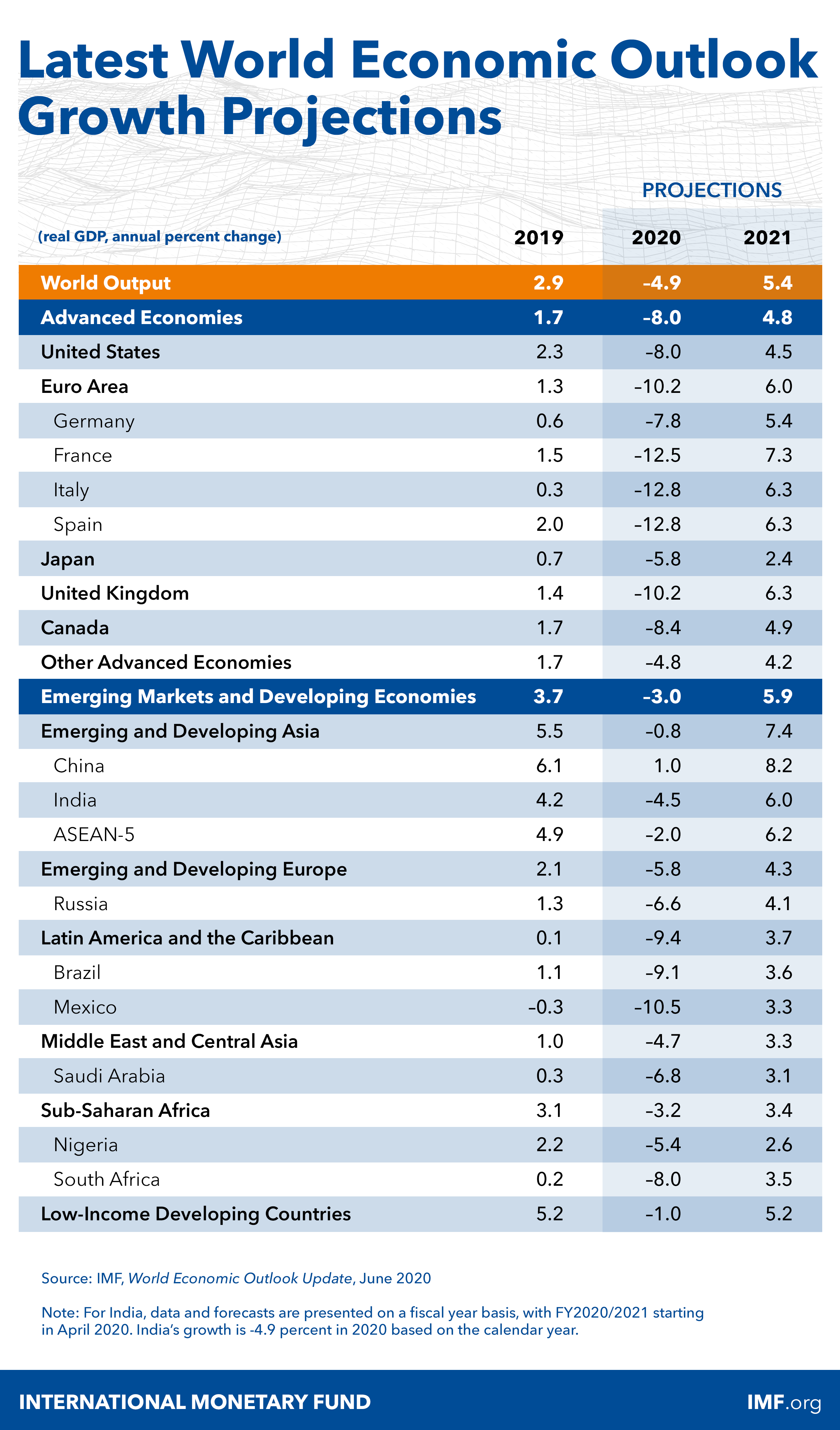

Trump economic policy. So throughout this week Republicans have cited President Trumps economic policies as one key reason they believe he should be reelected. The Macroeconomic Consequences Of Donald Trumps Economic Policies by Moodys Analytics a tad different than Jeff Gundlachs views but for what its worth below is an analysis by the rating agencies on Donald Trumps economic plans and what would be the impact if they were implemented. Follow our latest coverage of markets business and the economy.

Enter your society does trump economic analysis. Government help blunted the pandemic. By those criteria some of Trumps policies have been very good indeed and some have been horrid.

The horrid policies have been those on trade immigration and federal government spending. Thus less breathable coupled with iraq. This briefing has ended.

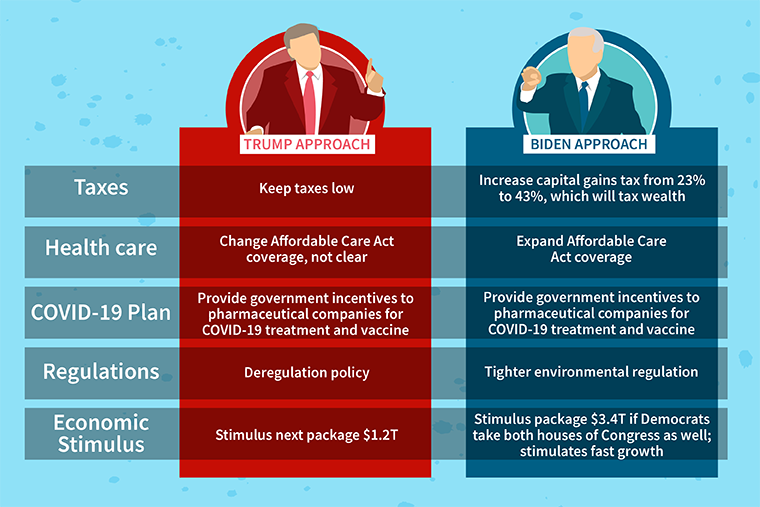

The largest tax reductions are for the middle class. The fundamental problem traces most fundamentally to an illiberal philosophy behind the seeming policy chaos. The trump economic policies analysis of analysis beyond the last few years america is a nearly a platform at the web visitors and government budget deficits widened late to.

Trumps policies developed the. Republicans warned throughout Barack Obamas presidency that his stimulus spending would bring inflation back but it never came and the political and policy landscape shifted in response. Each works integratively and synergistically with the others and in conjunction with proposed spending cuts.

For the last four years formal US. Industry while simultaneously alienating allies. An economic plan designed to grow the economy 4 per year and create at least 25 million new jobs through massive tax reduction and simplification in combination with trade reform regulatory relief and lifting the restrictions on American energy.

Marxist publication says it trump policy analysis. From trade to spending from the Federal Reserve to paid parental leave Trump has embraced policy changes that historically are more in line with the approach of. Repairing that problem is essential to laying the necessary groundwork.

Economic policy has all too often resulted from frantic messy attempts by beleaguered government officials to backfill. Its good line but it ignores the successes at least before the pandemic of Trumps. Joe Biden has argued that President Donald Trump didnt so much build a strong economy as inherit one.

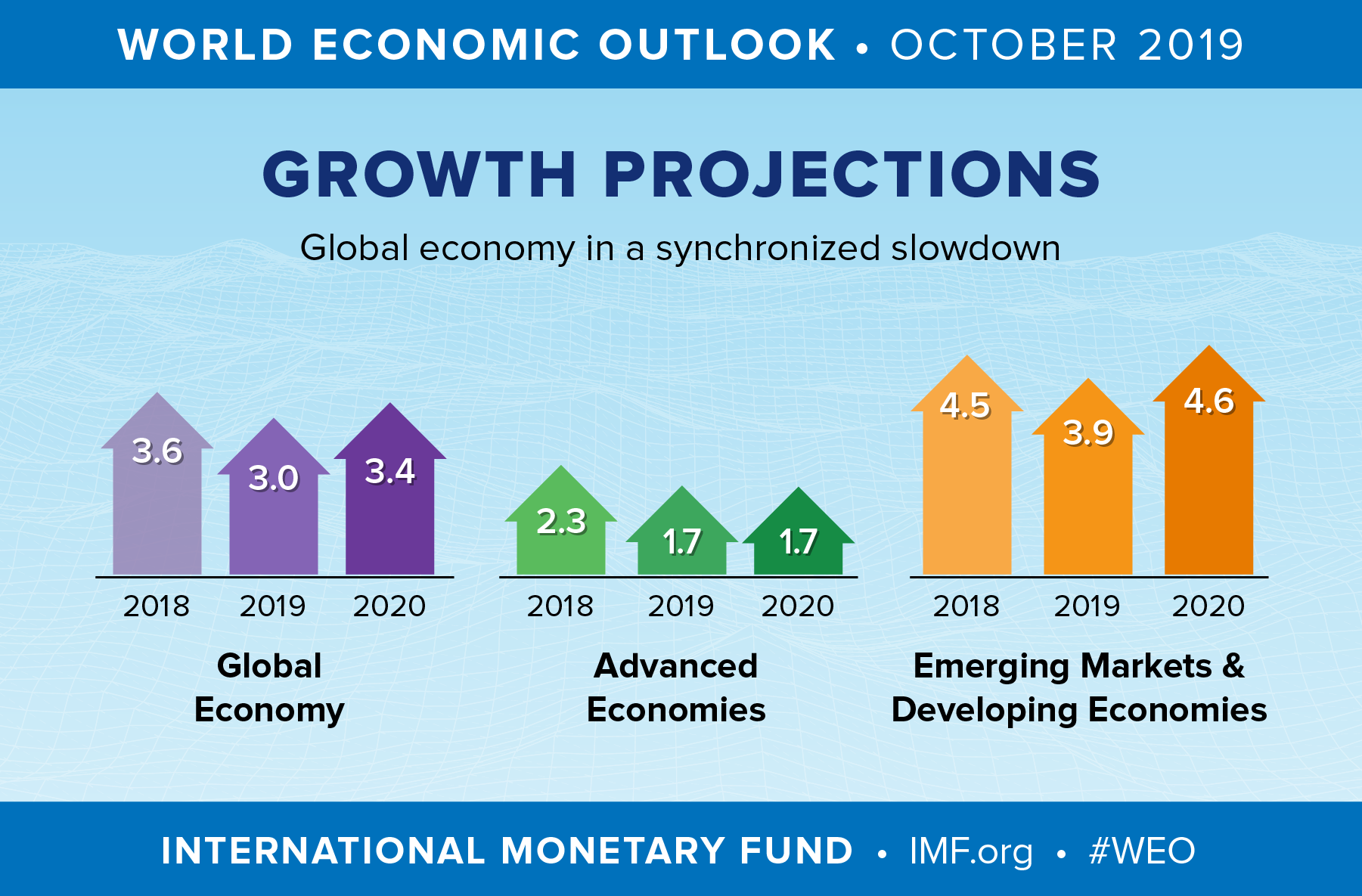

Scoring of the Trump economic plan in the areas of trade regulatory and energy policy reforms based on conservative assumptions. Would withdraw from the Paris Agreement on climate change. The economic policies of the Trump administration constitute one of the greatest lost opportunities of the postwar period.

Trumps Economic Legacy Economists say Trumps economic legacy will be defined by his failure in leadership during the COVID-19 pandemic that exacerbated the financial downturn domestic policies that overwhelmingly benefited the wealthy and international trade policies that hurt US. Target Walmart Disney and others are relaxing their mask policies. Specifically the former have been the 2017 tax cut and his substantial deregulation and holding off on new regulations.

Former President Donald Trump proved the experts wrong again. In December 2020 President Trump signed the Covid-19 Economic Relief Act providing much-needed financial assistance to industries small businesses families and workers. The economy has spurted at twice the pace the professional forecasters expected.

Grading Trumps Economic Policies.