Each point typically lowers the rate by 025 percent so one point would lower a mortgage rate. Discount points refer to prepaid interest as purchasing one point can lower the interest rate on your mortgage interest rate from 125 to 025.

What Are Mortgage Points The Truth About Mortgage

What Are Mortgage Points The Truth About Mortgage

How much does one mortgage point reduce the rate.

0.25 points mortgage. Suppose you applied for a loan when the rate was 35. But each point will cost 1 percent of your mortgage balance. Dont get thrown off if the loan officer or lender uses basis points to describe what youre being charged.

As a result the. Buying one point can reduce your interest rate by 025 but the exact discount can vary by lender. ARM loans eventually shift from charging the initial teaser rate to a referenced indexed rate at some margin above it.

An increase of a single basis point can be worth quite a lot. One point typically knocks off about 025 of the interest rate. Your loan officer says you can get 3625 or 35 with the cost of a quarter of a point 025.

Typically a point costs you 1 of the total amount of your loan. You can choose to pay a percentage of the interest up front to lower your interest rate and monthly payment. The discount varies from one lender to another and fluctuates in.

For example if you agree to a 4 mortgage paying two points upfront might result in your loan rate dropping by 050 to 35. This means when youre looking at a rate quote that includes points youd have to pay. The purchase of each point generally lowers the interest rate on your mortgage by up to 025.

So if you have a 400000 mortgage. A mortgage point generally reduces the mortgage rate by one eighth 0125 to one-quarter 025. But with many lenders each discount point you pay up front results in a reduction of your loan rate typically by 025.

Buying mortgage points when you close can reduce the interest rate which in turn reduces the monthly payment. If you have a 200000 15-year loan at 5. Lenders offer smaller interest rate discounts for fractional points.

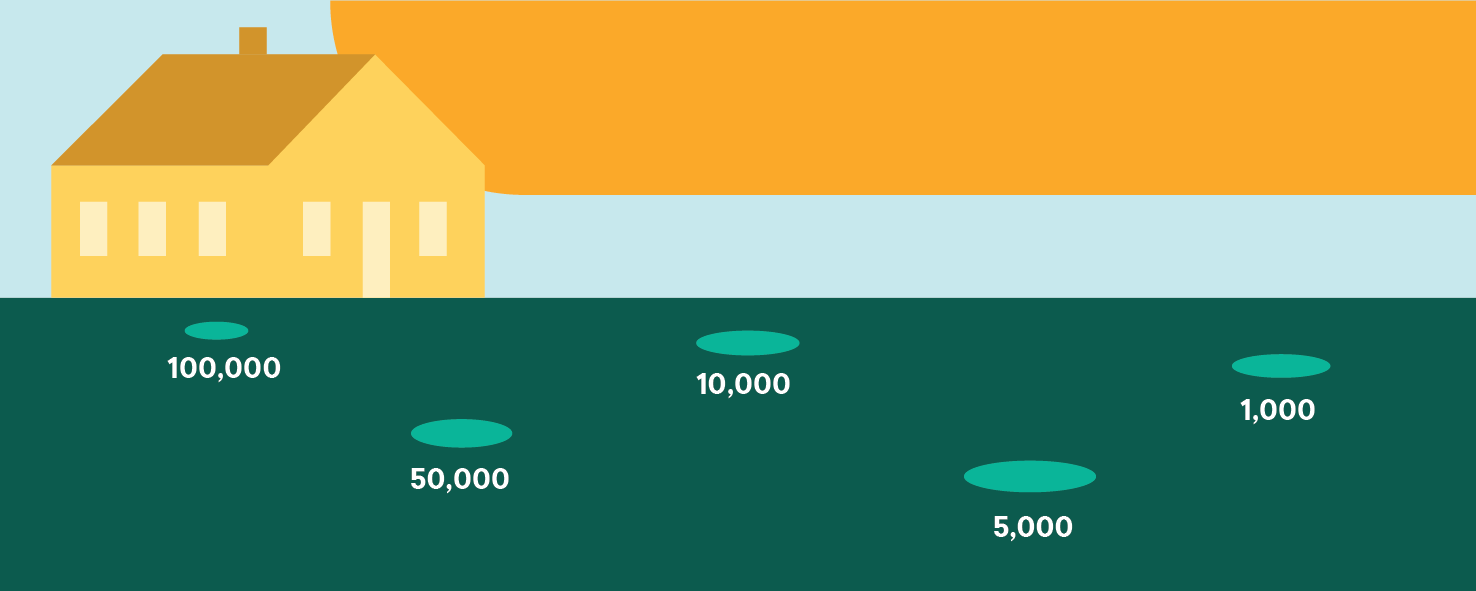

If no points or origination charges show up on your loan estimate the lender wouldnt be able to offer you this second option. For example on a 100000 loan one point would be 1000. What are basis points in mortgage.

So one point on a 300000 mortgage would cost 3000. A basis point in mortgage is a change equivalent to 001. While a point typically lowers the rate on FRMs by 025 it typically lowers the rate on ARMs by 0375 however the rate discount on ARMs is only applied to the introductory period of the loan.

Like normal mortgage interest that you pay over the life of your loan mortgage points are typically. If you were charged 25 basis points 025 itd be 250 and youd calculate it by entering 00025. Mortgage points also known as discount points are a form of prepaid interest.

For instance a half-point. And in exchange you can receive a reduction of approximately 025. You can buy partial points.

Learn more about what mortgage points are and determine whether buying points is a. If your interest rate is25 percent higher at 525 percent your monthly payment becomes 55220 a difference of about 15 a month. Typically for every point you purchase you get to lower your interest rate by 025.

This is known as buying positive points where each point is equal to 1 of the mortgage. Each discount point costs 1 of your loan size and typically lowers your mortgage rate by about 025. For example if your mortgage was at 362 and decreases by 15 basis points it is now at 347.

The amount of discount will vary by lender so its worth shopping around. When you buy one discount point youll pay a fee of 1 of the mortgage amount. A mortgage point is equal to 1 percent of your total loan amount.

Most lenders provide the opportunity to purchase anywhere from one to three discount points. When you are ready to lock in the rate is worse. Mortgage points which sometimes are referred to as discount points are a fee that you pay at the time you close the loan in exchange for a lower interest rate.

For example your 500000 mortgage at 45 requires a monthly repayment of 240676.