Our Objective Thank you for visiting Government Refinance and Home Purchase Assistance. The HAMP reduces your loan payments to 31 of your verified monthly income.

With Mortgage Rates So Low Is Now A Good Time To Refinance

With Mortgage Rates So Low Is Now A Good Time To Refinance

Government Mortgage Relief Programs Loan Modification.

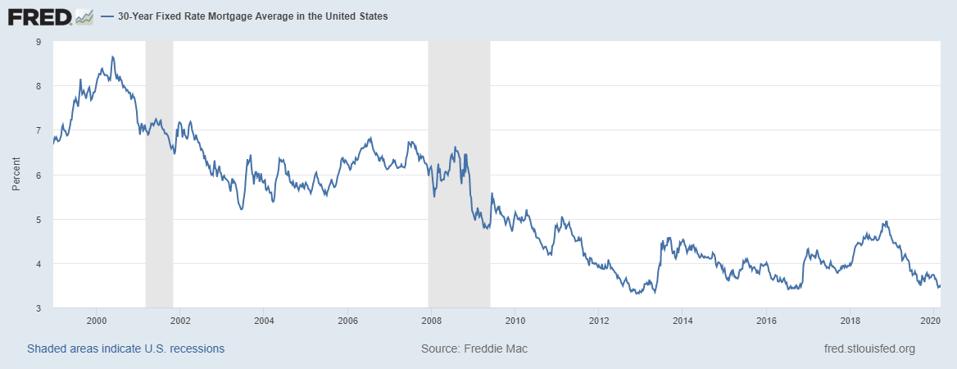

Government mortgage rate reduction. As you prepare for the possible spread of the coronavirus or COVID-19 here are resources to protect yourself. 30-Year Fixed-Rate Mortgages. Mortgage rates had enjoyed a solid little run for almost all of April and again in the first week of May.

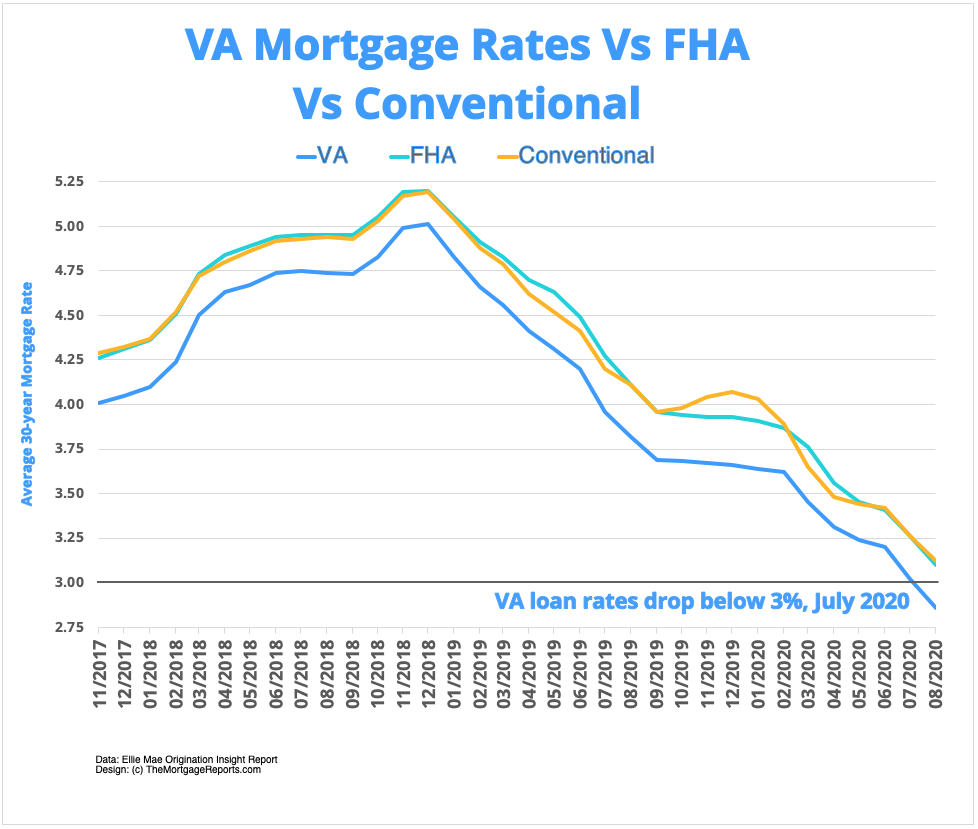

If you have an existing VA-backed home loan and you want to reduce your monthly mortgage paymentsor make your payments more stablean interest rate reduction refinance loan IRRRL may be right for you. You pay a lump sum of cash to your lender which is applied to your outstanding principal balance. Reverse mortgages are increasing in popularity with seniors who have equity in their homes and want to supplement their income.

This may lower your monthly payment. Federal Government is called a Home Equity Conversion Mortgage HECM and is only available through an FHA-approved lender. How the Mortgage Interest Deduction May Not Help.

By last Thursday they were at their lowest levels in more than 2 months in many cases. Interest rate reduction. As noted earlier the TCJA significantly raised the standard deduction.

The purpose of a mortgage loan modification is to get your monthly payment to a more affordable level. If youre struggling to make mortgage payments or facing foreclosure the FTC wants you to know how to recognize a mortgage assistance relief scam and exercise your rights under the Rule. If you take this credit you must reduce your mortgage interest deduction by the amount of the credit.

If you cant make your mortgage payments because of the coronavirus start by understanding your options and reaching out for help. The only reverse mortgage insured by the US. Over the last two decades the fed funds rate and the average 30-year fixed mortgage rate have differed by more than 5 and by as little as 050.

A government program that reduces mortgage defaults Study finds Housing Finance Agencies provide crucial help. 27-Aug-2020 800 AM EDT. A mortgage recastlowers your monthly mortgage payments.

An adjustable-rate mortgage has lower rates and payments early in the term compared with a fixed-rate mortgage but rates can dramatically increase over the life of the loan. For a 30-year fixed-rate mortgage the average rate youll pay is 305 which is a decrease of 2 basis points. This is achieved by modifying one or more components of your mortgage.

An affordable mortgage payment is typically defined as 31 of the borrowers monthly gross income. Our mission is to provide timely and useful information to help Americans understand and take advantage of the ever-changing government-backed mortgage programs. These home loans feature interest payments over a relatively short term of five to 10 years after which a lump sum payment is made.

You may be able to claim a mortgage interest credit if you were issued a mortgage credit certificate MCC by a state or local government. For tax year 2019 it is 12200 for single filers and 24400 for married couples filing jointly. By initiating the review the government is signalling a small rate reduction for the 1100 pensioners who have reverse mortgages with.

Your loan repayment term and interest rate wont change however. This may lower your monthly payment. As this happens and the interest rate on the 10-year Treasury bond which influences the rate on the conventional 30-year mortgage moves up mortgage rates also tend to rise.

If interest rates are lower now than when you locked into your mortgage loan you may be able to modify your loan and get a lower rate. Learn about mortgage and housing assistance options. Pressure on government to match super-backed reverse mortgage.

Figure the credit on Form 8396 Mortgage Interest Credit. Refinancing lets you replace your current loan with a new one under different terms. If your mortgage is backed by the federal government provisions of the 2020 CARES Act allow you to potentially suspend payments for up to.

Your lender then recalculates your monthly payments based on the reduced balance amount. Find out if youre eligibleand how to apply. Before TCJA took effect the standard deduction was 6350 for single filers and 12700.

The PRA works with lenders and serving companies to reduce the. And even if the foreclosure process has already begun the FTC and its law enforcement partners want you to know that legitimate options are available to help.