A consumption tax is in essence a sales tax along every point of product distribution where money changes hands. In the present dollars it would absolve someplace around what might be compared to middle family pay for a group of four-about 43000.

Consumption Tax Training Course

Consumption Tax Training Course

In 2015 Chinas consumption tax revenue amounted to RMB 8907 billion.

What is consumption tax. A consumption tax could impose higher rates on sin items such as alcohol. Rather than taxing most income it would generate reasonable revenues by taxing the purchase of goods and services. For instance if the standard finding for a wedded couple was 15000 dollars and every close to home exclusion.

The Flat Consumption Taxes proposed by Steve Forbes when he ran for president was a good thought. It takes place in Japan it is performed by a business for its business purposes it is performed for the purpose of obtaining compensation and it takes place through the transfer or lease of assets. It is similar in some respects to a sales tax except that with a sales tax the full amount owed to the government is paid by the consumer.

Consumption taxes are a major source of revenue for governments around the world. Income not spent on goods or services or savings would not be taxed. What does CONSUMPTION TAX mean.

This approach to taxation is. Consumption tax is the tax levied on spending by the consumer for purchasing products or services. Consumption tax however an individuals tax liability would be determined by total expenditures on goods and services.

As with many tax policies. The Progressive Consumption Tax PCT changes the way we look at our tax system and revenues needed to build roads and bridges and keep our nation safe. Consumption taxes can take the form of sales taxes tariffs excise and other taxes on consumed goods and services.

It is a type of indirect tax which is paid by the consumer along with the cost of the product at the time of purchase. Rather than paying a tax on earnings people would only be required to pay taxes on goods and services that they consume. If you purchase something from a grocery store or another retailer it is likely that you will pay tax on that purchase.

Consumption tax a tax paid directly or indirectly by the consumer such as excise sales or use taxes tariffs and some property taxes eg taxes on. Consumption tax is imposed on all the individuals and organizations which manufacture and import taxable products process taxable products under consignment or sell taxable products. 12 rows Consumption Tax The consumption tax is imposed on the entity and.

And the income tax youre fundamentally taxed when you earn money or when you get interest dividends capital gains and so on. The consumption tax applies on taxable sales and a sale is considered to be taxable when it complies with the following four conditions. A consumption tax is a tax on the purchase of a good or service.

One new approach to taxation called a consumption tax would allow individuals to control how much tax they pay each year by controlling how many things they actually purchase. CONSUMPTION TAX meaning - CONSUMPTION TAX definition - CONS. Consumption taxes are any type of taxation imposed by a local state or national tax agency on the purchase of certain goods and services such as clothing gasoline or a restaurants prepared food.

Think of it like a sales tax but on a much larger scale. A consumption tax essentially taxes people when they spend money. Those who advocate a consumption tax to replace income taxes make several points that seem appealing to the average taxpayer.

Consumption taxes can take many different formswhich differ in when the tax. Lets imagine you make a widget in Texas. A value-added tax VAT is a flat-tax levied on an item.

Under Representative Whites plan when.

New Oecd Study Consumption Tax Revenue During Economic Downturns

New Oecd Study Consumption Tax Revenue During Economic Downturns

The Ins And Outs Of Consumption Tax Vat Gst And Sales Tax Quaderno

The Ins And Outs Of Consumption Tax Vat Gst And Sales Tax Quaderno

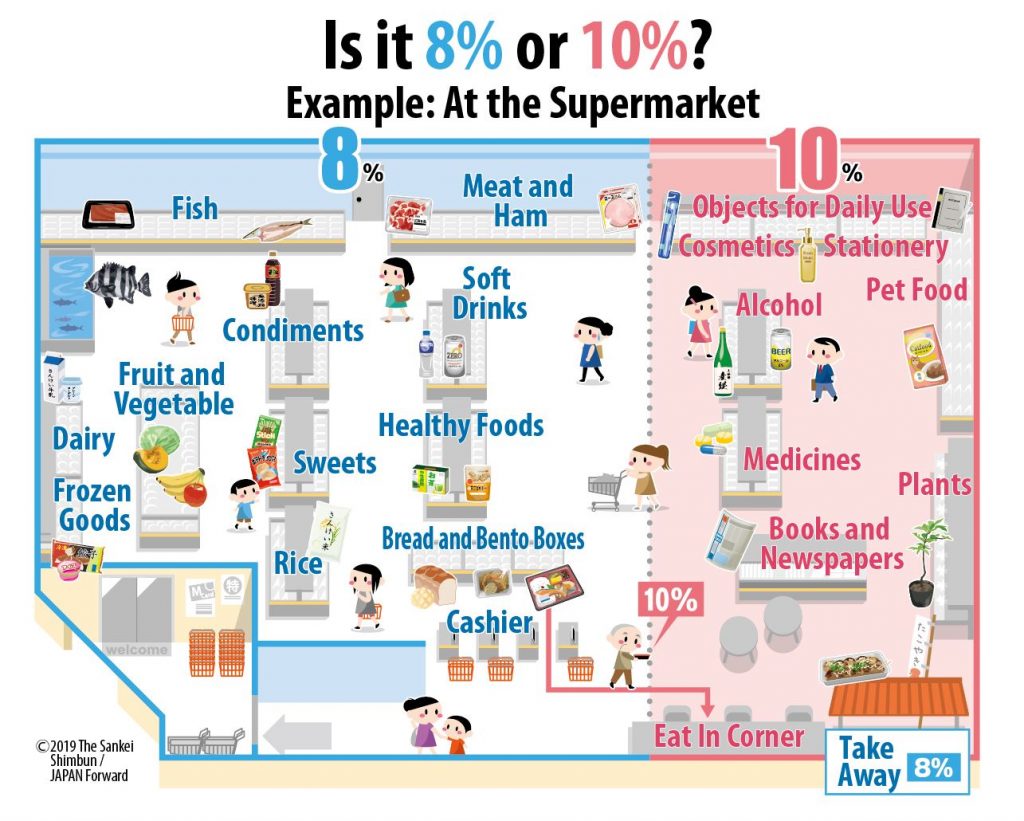

Japan S New Consumption Tax Info And Vocabulary Illustrated Guide

Japan S New Consumption Tax Info And Vocabulary Illustrated Guide

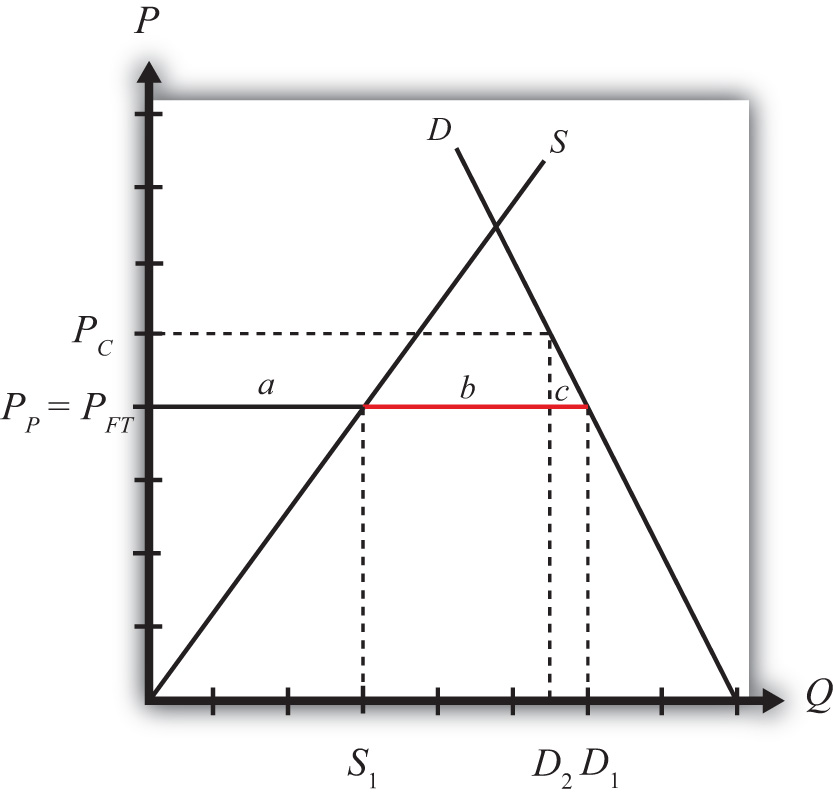

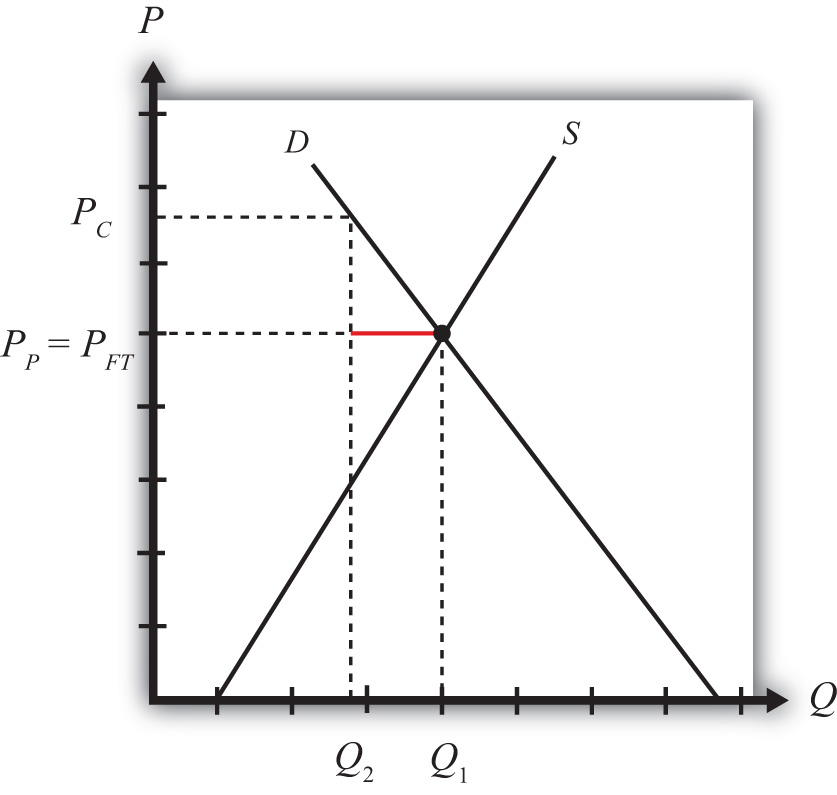

Consumption Tax Incidence Download Scientific Diagram

Consumption Tax Incidence Download Scientific Diagram

Japan S Consumption Tax By October 1 Which Products Services Get 8 And 10 Japan Forward

Japan S Consumption Tax By October 1 Which Products Services Get 8 And 10 Japan Forward

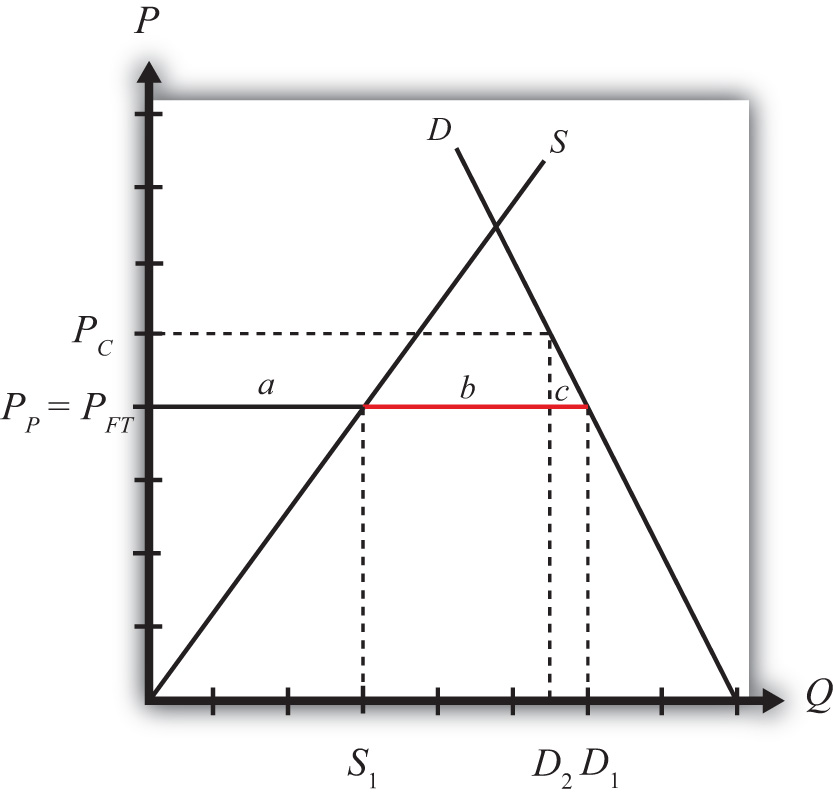

Trade Chapter 95 2b Consumption Tax Effects In A Small Importing Country

The Case Against A Consumption Tax Naked Capitalism

The Case Against A Consumption Tax Naked Capitalism

Consumption Tax Effects In A Small Importing Country

Consumption Tax Effects In A Small Importing Country

Consumption Tax The Following Figure Shows That A Chegg Com

Consumption Tax The Following Figure Shows That A Chegg Com

Consumption Taxes As A Reason For Trade

Consumption Taxes As A Reason For Trade

Should Airlines Raise Ticket Prices During A Tax Holiday Tax Foundation

Should Airlines Raise Ticket Prices During A Tax Holiday Tax Foundation

Consumption Tax Incidence Download Scientific Diagram

Consumption Tax Incidence Download Scientific Diagram

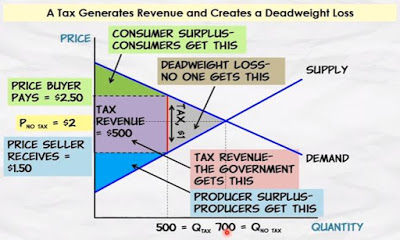

What S The Dead Weight Loss Of A Consumption Tax When Externalities Are Present Econbrowser

What S The Dead Weight Loss Of A Consumption Tax When Externalities Are Present Econbrowser

What Is Consumption Tax What Does Consumption Tax Mean Consumption Tax Meaning Explanation Youtube

What Is Consumption Tax What Does Consumption Tax Mean Consumption Tax Meaning Explanation Youtube

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.