Prioritise paying off debts above building up savings since the interest on debts will far outstrip. However our research suggests that few staff members fully understand the financial.

Early Retirement Now You Can T Afford Not To Retire Early

Early Retirement Now You Can T Afford Not To Retire Early

I typically use 20 or 25 to be safe.

Early retirement now. Early Retirement ist eine Bewegung die wie so viele Trends aus den USA kommt. If you put off early retirement from 55 to 59 the amount you need falls to just 315000. This has a huge impact on how much money you need to retire early.

Create a mock retirement budget to plan your expenses. Is 370000 still too much for you. Expected Tax Rate At Retirement.

If the member has made buy-ins for early retirement but does not take early retirement the balance of the buy-ins is forfeited to the pension scheme if the retirement benefit would be more than 5 higher than that of a member who has made no buy-ins for early retirement. Evaluate your current financial situation. For example if you simply get a job at a local.

During the time in 2016 before Bob2 retired and after speaking to a fellow FIRE retiree we opened new retirement accounts at Fidelity and rolled over our entire portfolio from Vanguard to Fidelity. Early retirement can have the dark side I agree inadequate financial payouts that does not take into consideration the fact that cost of living is very high as a friend of mine would say there is so much month after the money loosely translating to the length of the month from one pay day to the next. There is no way to predict what tax rates will be in 5 10 20 or 30 years but the commonly held belief is that your tax rate will likely be lower when you retire and are making little to no income.

Youll be living with low income for the rest of your life The average monthly Social Security benefit for retired workers is 1503. The amount youll get. Another 35 of the early retirees said they.

In the 2019 survey 43 of respondents reported retiring earlier than planned and of that group 33 said it was because they could afford to do so. Work out how much money you need to save andor invest to. Heres our Unbiased step-by-step guide on how to retire early.

Pay off your mortgage. The earliest you can get your State Pension is when you reach your State Pension age. To retire at 62 all you need is 260000.

On the financial side post retirement we rolled our Traditional 401k Roth 401k and TSP funds from our old coal mines into our retirement accounts at Vanguard and promptly bought VTSAX. Its usually good to make overpayments on your mortgage if you can afford them. If you go out early and take Social Security early that reduction is for the rest of your life says Doonan.

There is no longer a fixed age at which you have to retire. In seiner einfachsten Form bedeutet es FrührenteAuf Early-Retirementde sprechen wir aber nicht von der theoretischen Möglichkeit mit 64 statt 67 in die Rente zu gehen genauso wenig möchten wir uns bei einem Erreichen des Early Retirements nur auf die faule Haut legen. They are also better informed on recent pension changes and have.

If youre prepared to work part-time in retirement the amount you must save falls even further to a figure that is well within the reach of most families. I think its unlikely that we will be taxed at more than. 9 Steps to Retire Early Determine the lifestyle you want when you retire early.

Youll have to wait to claim your State Pension if you retire before you reach that age. However youll need to be in a secure financial position to fund your retirement years before you give up work. Those retiring early are willing to take a hit a 2200 hit on their annual retirement income in exchange for giving up work early.

Keep in mind that you can still work some in retirement at least in the first few years which might help make an early retirement possible. Hat sich der Versicherte für eine frühzeitige Pensionierung eingekauft ohne. Unless supplemented there is so much life after the payout The retirement payout shrinks day.

Its now up to you and you can retire early if thats your chosen option. At each annual salary and benefits review and throughout the year staff are nudged towards the option of taking early retirement. Understandably many grab this opportunity with both hands and the subsequent peer pressure creates a situation where early retirement is seen as the norm.

But 67 percent of retirees on Social Security get less than that because they claimed their benefits before they reached full retirement age 67 for people born.

Early Retirement Now With Karsten Jeske

Early Retirement Now With Karsten Jeske

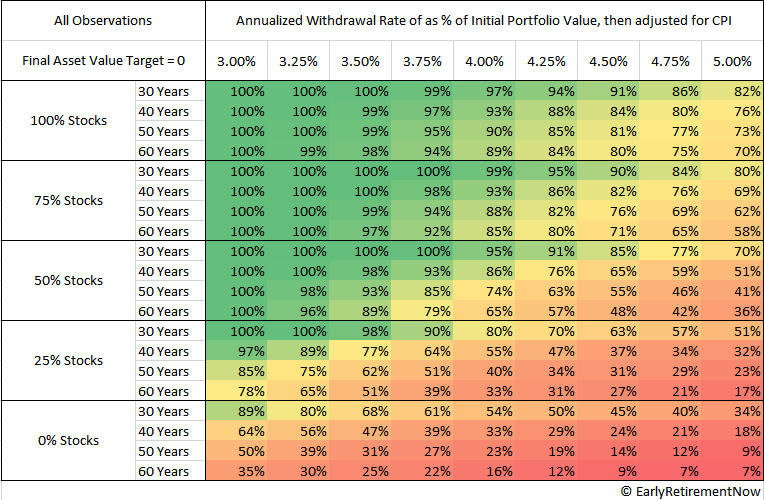

Study On Swr Rates For Early Retirement Bogleheads Org

Study On Swr Rates For Early Retirement Bogleheads Org

How To Plan For An Early Retirement Now 40billion

How To Plan For An Early Retirement Now 40billion

Early Retirement Can You Afford To Retire Now Your Money Your Wealth Podcast 320 Pilnytis

Early Retirement Can You Afford To Retire Now Your Money Your Wealth Podcast 320 Pilnytis

How To Retire Early How Much Money Do You Need To Retire Find Your Fire Number Millennial Money Honey

How To Retire Early How Much Money Do You Need To Retire Find Your Fire Number Millennial Money Honey

Early Retirement 3 Simple Things You Should Do Now If You Want To Retire Early The Job And Entrepreneur Guide

Early Retirement 3 Simple Things You Should Do Now If You Want To Retire Early The Job And Entrepreneur Guide

The Ultimate Guide To Safe Withdrawal Rates Part 11 Six Criteria To Grade Withdrawal Rules Early Retirement Now

The Ultimate Guide To Safe Withdrawal Rates Part 11 Six Criteria To Grade Withdrawal Rules Early Retirement Now

So What We Retired At The Peak Of The Bull Market Here Are Seven Reasons Why We Re Not Yet Worried Early Retirement Now

So What We Retired At The Peak Of The Bull Market Here Are Seven Reasons Why We Re Not Yet Worried Early Retirement Now

Dividends Early Retirement Now

Dividends Early Retirement Now

Early Retirement Now How Much Of A Random Walk Is The Stock Market Bogleheads Org

Early Retirement Now How Much Of A Random Walk Is The Stock Market Bogleheads Org

Early Retirement Now You Can T Afford Not To Retire Early

Early Retirement Now You Can T Afford Not To Retire Early

Karsten Jeske Your Money Your Wealth Guest Interview

Karsten Jeske Your Money Your Wealth Guest Interview

Podcast Phd On Fire Safe Draw Down Rates With Karsten Jeske Aka Bigern Newretirement

Podcast Phd On Fire Safe Draw Down Rates With Karsten Jeske Aka Bigern Newretirement

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.