As of December 15 2015 the US. Bureau of Public Debt 10Y 25Y 50Y.

National Debt Of The United States Wikipedia

National Debt Of The United States Wikipedia

Households could not afford to pay for medical care up front or when they received care in 2017 according to new US.

What is the united states debt right now. They would ultimately profit from the debt of the United States government. This is largely because the United States was forced to borrow money from the reserve much as they do today. Debt per person is calculated by dividing the total debt outstanding by the population of the United States as published by the US.

Over time some began to question this set up. 1 Most headlines focus on how much the United States owes China one of the largest foreign owners. The survey asked whether respondents had medical bills they.

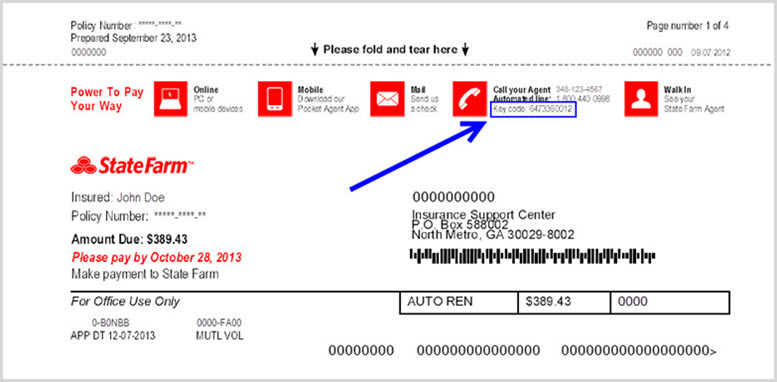

The Survey of Income and Program Participation SIPP in 2018 added a new question about medical debt in the previous year. But it does not. Federal budget deficit was projected to reach 23 trillion in 2021.

This debt-based monetary system is systematically destroying the wealth of this nation. The national debt - aka the federal debt - is the total of all the past years budget deficits minus what the government has paid off with budget surpluses. If you stop right now and pull a dollar out of your wallet what does it say right at the top.

During fiscal year 2017 the total. An Overview of the United States National Debt. Is 188 trillion in debt.

This measure of debt known as debt held by the public includes the Treasury securities held by the Federal Reserve but not those held by the Social Security trust funds By the middle of. Corporate tax rate is now more in line with the rates of other advanced economies. What many people dont know is that the Social Security Trust Fund also known as your retirement money owns most of.

Tax code has many preferences that. This week the United States national debt ticked above US22 trillion for the first time an amount equivalent to 67000 per US. Nineteen percent of US.

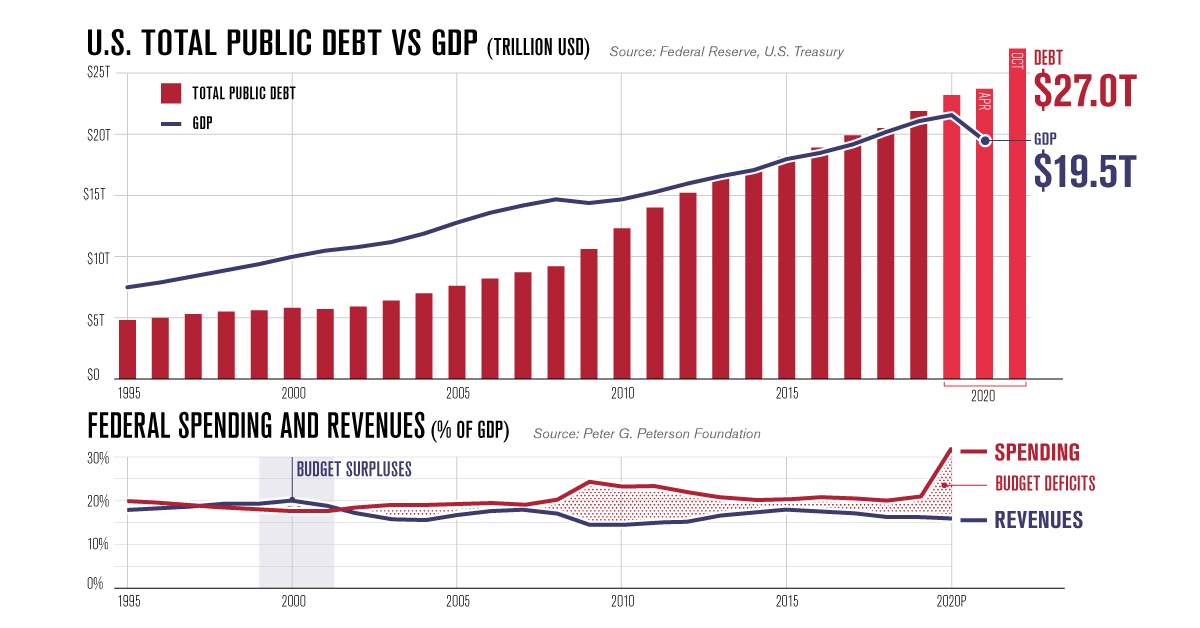

Many researchers even question whether the. Debt reached a new high of 281 trillion as of March 31 2021. The United States budget deficit hit a record 864 billion in June as the government continued pumping money into the economy to support workers and businesses slammed by the pandemic.

Every man woman and child in the United States currently owes 84099 for their share of the US. The 2020 deficit of 31 trillion as a result of the COVID-19 pandemic would have taken the top spot. Unfortunately United States Notes are not being issued today.

Normally the way our current system works is that whenever more Federal Reserve Notes are created more debt is also created. Foreign investors can purchase US Treasury bonds to help fund their own countries. Since the Tax Cuts and Jobs Act TCJA was enacted in December 2017 the US.

The 28 trillion and growing gross federal debt equals debt held by the public plus debt held by federal trust funds and other government accounts. The current US debt at around 227 trillion is unlikely to be paid off with any speed. Despite the nations economic recovery and the end of the wars in Afghanistan and Iraq the US.

In fact as the worlds principal reserve currency there are some ways in which the American national debt is good for other countries. It says Federal Reserve Note. What is the National Debt.

Economy crossing a threshold that has long worried deficit hawks and many economistsAt the end of. Census Bureau data on the burden of medical debt. Sunday May 9th 2021.

In fact each bill said United States Note right at the top. Debt-to-GDP ratio has remained above 100 percent since 2013. US National Debt Clock.

Gross federal debt in the United States increased to 10760 percent of the GDP in 2020 from 10690 percent in 2019 according to estimates from the Office of Management and Budget. However following the Act of 1871 bankers and private companies were able to operate out of the District of Columbia. The Current Outstanding Public Debt of the United States is.

Can the United States pay off its national debt. The current federal statutory tax rate on corporate income is 21 percent this does not include the average of corporate taxes imposed at the state and local levels. The national debt is now roughly the size of the US.

It would have been the second-highest deficit since 1945.